Articles

【Mines game】2,131% Abnormal Liquidations Imbalance Stuns Bitcoin (BTC)

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin (BTC) just made a move that is hard to ignore. After three failed attempts to break a stubborn downtrend - January, February and March all said “nope” - BTC officially cracked through on April 15, sending signals across the crypto market that bulls might be waking up.

AdvertisementAs of now, BTC is trading around $85,844, up 1.48% on the day. But the real story? The liquidation data.

Related  Tue, 04/15/2025 - 11:00 Bitcoin (BTC) Ready for $100,000? Key Level Just Crossed

Tue, 04/15/2025 - 11:00 Bitcoin (BTC) Ready for $100,000? Key Level Just Crossed  Arman Shirinyan

Arman Shirinyan

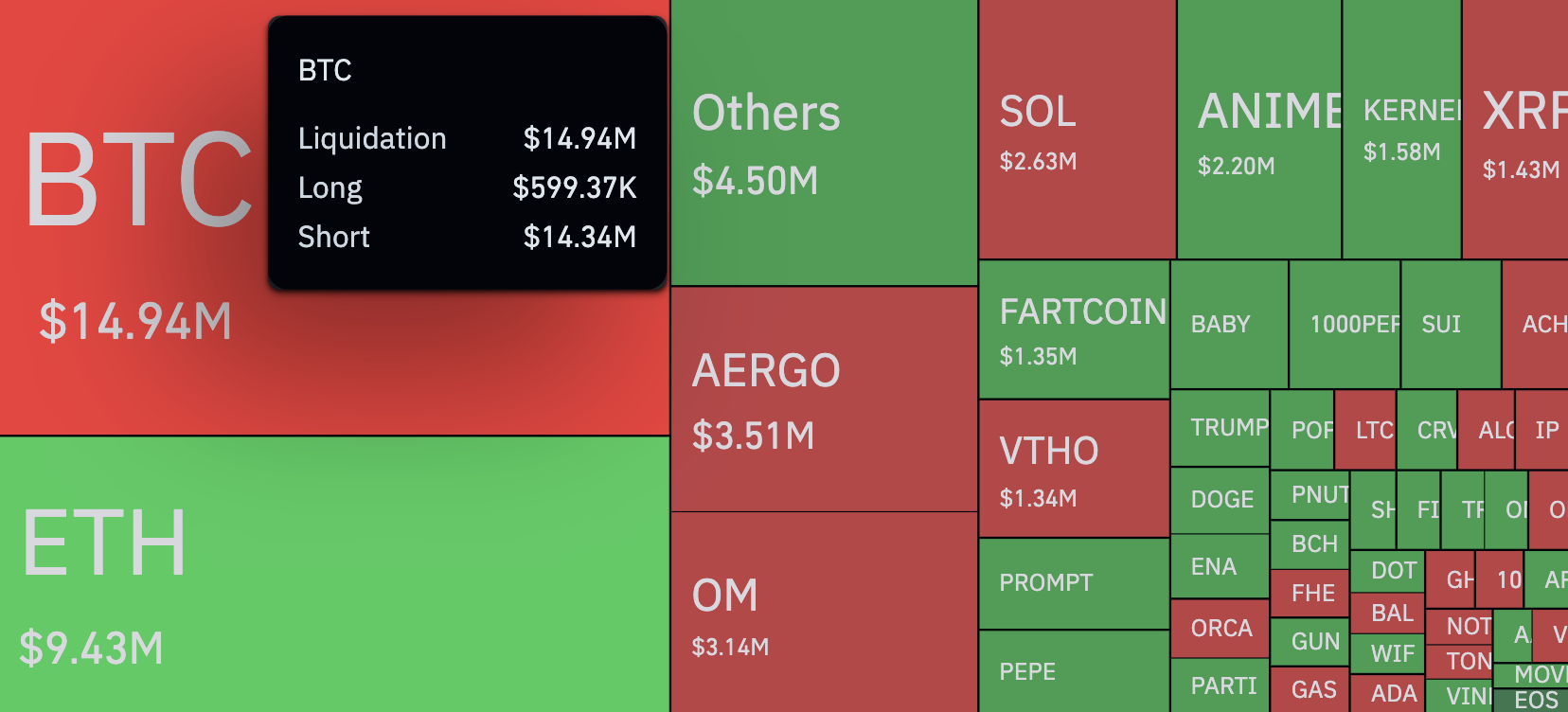

Over the past 12 hours, $14.94 million in BTC positions were liquidated, but only $599,000 were longs, while $14.34 million were shorts. That’s a 2,131% imbalance - a massive short squeeze that has caught bears off guard.

Advertisement

Zooming out to the wider market, $57.43 million in total positions were wiped out in the same 12-hour window, with shorts taking the brunt - $33.61 million versus $23.82 million in longs. Across the last 24 hours, liquidation totals hit $188.37 million, with nearly 92,000 traders "rekt." One trade got hit hard in particular, with a $3.43 million liquidation on OKX’s BTC/USDT pair, according to CoinGlass.

Related  Tue, 04/15/2025 - 09:04 Bitcoin to Behave Similarly to Gold for Next Few Thousand Years: US Government’s Top Crypto Executive

Tue, 04/15/2025 - 09:04 Bitcoin to Behave Similarly to Gold for Next Few Thousand Years: US Government’s Top Crypto Executive  Yuri Molchan

Yuri Molchan

What caused the surge? As mentioned, BTC had been testing a descending trendline since the start of the year. Today it broke out cleanly, which suggests that bears may have overstayed their welcome.

Some traders are saying this is the start of a bullish reversal, especially since Bitcoin is holding strong above the breakout level. Others think this could just be a temporary squeeze with limited follow-through.

At the end of the day, this move is exciting, but it is also risky. Short-term liquidations can cause big price swings, but they do not guarantee long-term trend changes.